Making the grade

Homework leads to financial success

By Jim Brigance

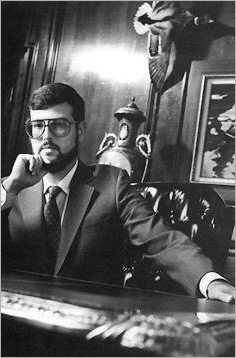

A Dallas financial manager is quietly adding zeroes to his clients' bank accounts with an astute land investment matrix that minimizes risks while maximizing returns. Joseph J. Tallal Jr.'s unique investment philosophy is demonstrably successful. From 1975 to 1985, he has provided a 63.89 percent net average annual return to his clients on their collective portfolios. Of the 46 land investments he has put together, 33 already have sold. These properties were first acquired for $25 million and were held for an average of 3.5 years. They sold for $51 million. Tallal's remaining 13 properties were purchased for $69 million and in just over two years are valued at $157 million, a growth of more than 100 percent.

A Dallas financial manager is quietly adding zeroes to his clients' bank accounts with an astute land investment matrix that minimizes risks while maximizing returns. Joseph J. Tallal Jr.'s unique investment philosophy is demonstrably successful. From 1975 to 1985, he has provided a 63.89 percent net average annual return to his clients on their collective portfolios. Of the 46 land investments he has put together, 33 already have sold. These properties were first acquired for $25 million and were held for an average of 3.5 years. They sold for $51 million. Tallal's remaining 13 properties were purchased for $69 million and in just over two years are valued at $157 million, a growth of more than 100 percent.

Tallal developed his "investment matrix" as a by-product of analyzing financial clients' prior success and failure records.

"All of my clients have been very high-income professionals," he explained. "They invest from $60,000 to $300,000 per year. In the early 1970s, I sorted their investments that were doing well from those that were not. I made two stacks on my desk, one for successes and one for failures."

Tallal examined those records closely and was surprised to learn they all shared one common ingredient: They had made most of their money in raw land investments. "From there, I began studying the business of land investment and developing the philosophy necessary to maximize returns while minimizing risks."

There is a natural law at work that Tallal said governs the investment field, called "risk versus return." This means there is normally a direct correlation or relationship between the potential return that can be realized from an investment and the degree of risk underlying that investment. Simply stated, the higher the potential return, the greater the risk.

"Since everybody thinks that a passbook savings account is secure, and because it is insured by the FDIC, the risk is nominal and so is the return. On the other hand, commodities are seen as risky enterprises, and they are, because most investors lose their money. Because of the degree of risk, they command a higher return potential."

Tallal approaches any investment as a form of gambling. He said gambling at Las Vegas may be the riskiest "investment" possible with the highest and quickest potential for return or loss.

However, casino owners look at it in a different way. The casino is not gambling. It is investing its money. Because the casino has thoroughly analyzed the games, calculated the odds and altered the rules of the games, the odds are always in the casino's favor.

The Las Vegas concept of rearranging the risk-versus-return rules through acquired knowledge made Tallal question whether he could apply the same formula to his clients' investments. By deep analysis of his clients' portfolios, Tallal said, he was able to develop an investment matrix that incorporates the successful common denominators while excluding the failing ones.

In analyzing how Tallal's performance compares to investment alternatives over the past decade, remarkably he has produced a return double that of the second best performer, U.S. coins. Simplified, here are the key elements in the Tallal investment matrix:

- Quality. The location of a given piece of property is, above all, its most important characteristic. Its quality is further measured by the neighborhood, current use, zoning, development trends and other factors bearing on its potential use.

- Major players. The size of your investment may have no appreciable effect on the surrounding area. But the kind of developers around you may have a significant impact. Tallal said it is imperative to purchase in an area where nearby large investors and developers have the financial and political clout to produce substantial positive effects on trends, the market, development and future value of the whole area.

- Maximum leverage. Whenever possible, the purchase is achieved with 100 percent financing, usually provided by the seller. A fully leveraged investment allows the investor to increase significantly his capital potential over that of a normal cash transaction.

- Personal liability. Any note executed by the purchaser to leverage the property must be free of all personal liability. This no personal liability condition allows the investor to enjoy all of the upside potential of a fully leveraged investment without the downside risks always inherent with such leveraged arrangements.

- Zoning/utilities. Potential development of the land is critical. Maximizing its ultimate use will create maximum values for you. The right kind of existing zoning, or the ability to get it, is essential, as are the right utilities.

- Holding period. Ideally, a tract of land is held four to seven years. This is important because it is much too easy to buy early or sell late. Tallal recommends that, as with growth stocks, "a lot of the risks can be avoided by foregoing the first 20 percent of growth and not waiting around for the last 20 percent of growth."

A review of the 33 investments made by Tallal from 1975 to 1985 showed that a $10,000 investment in each would have produced a net return of $28,800.

Tallal pointed to several land investment programs that he said are classic examples of how his investment matrix works. One case involved land around Dallas-Fort Worth International Airport at a time when feverish speculation was becoming absurd.

"Through the 1970s, land around the airport was highly over-speculated," he said. 'At one point, l was tracking a 130-acre parcel that had escalated in price to $70,000 an acre. There was no real correlation between the value and the price. l believed the market was a full 10 to 15 years away. Then the bottom fell out. Through defaults, the property reverted to the original owners. Three years later, my clients purchased the property for $15,000 an acre ($1.95 million). The total cost to close this transaction was $199,000-one year's prepaid interest plus $4,000 principal."

In less than a year, Tallal's clients were offered $25,000 an acre for the property, which meant their $199,000 investment had become a return of $1.3 million. "If land is acquired properly, you should know at the time of acquisition how much profit you expect to earn. The only unknown factor should be how long it will take you to make it."

In August 1982, Tallal put together a three-member group that bought 38.2 acres in North Dallas for $1.1 million. In October 1983, the group sold for $2.7 million.

"There really isn't anything mystical or magical about earning big dollars in land investments," he said. "But you have to know which property to acquire and you have to have investors who will follow your advice."

Tallal, a multi-millionaire at 34, shared some of his expertise in a book titled Charting Your Course to Financial Independence. It is a simple navigational course through the tax maze, inflation investment pitfalls and other money matters that can make the difference between being in the financial condition of the average American and becoming truly financially independent.

Although Tallal is considering other prospective areas in the nation, he has to date confined his land investment activities to the Dallas-Fort Worth market. Most experts agree the area will double in population by the turn of the century, and the existing land can only become more valuable. Tallal is putting together packages involving even greater sums of money, some of which will be invested by securities and pension programs. "I have always believed in buying in a buyer's market and selling in a seller's market," he said. "For the first time in several years, Dallas is definitely a buyer's market."

Tax law changes will not affect his unique investment philosophy because, he said, "I make money only sharing in my clients' profits, so my investments have always been structured for economics. Tax sensitivity has always been a second consideration and not the first.

Real profits are made at the time of acquisition. They are only collected at the time of disposition."

"I want to make my investment programs available to a broader spectrum of investors. I plan to work on ways to reduce the minimum level of entry and continued carrying costs on my investments. I would like to see the $25,000-to $50,000-a-year investor have a chance to participate in an investment program that really offers a fair chance to make a significant return."

Tallal is the first to agree that land is the best investment. "We all know that they aren't making any more of it, but fortunately, they don't have to. The secret is buying the right land with the right financial arrangement."

Mr. Tallal current focus is structuring real estate investments for his clients. The minimum investment amount is usually in the $25,000 per year range. If you would like to find out more about how you can become one of Mr. Tallal's clients, E-mail him now.